Top 10 UK Airbnb Markets to Invest

Key Takeaways:

The UK’s short-term rental market is expanding fast, and investors who choose the right city can tap into strong demand, solid occupancy and high nightly rates.

Success depends on picking a market with year-round appeal, sensible regulations, strong ROI potential and a property type that matches local traveler demand.

Cities like Manchester, Liverpool, Birmingham, Edinburgh and London offer high occupancy and strong revenue potential, while places like Ashford and Nottingham provide more affordable entry points.

Each top UK market attracts different guest segments — from business travelers to festival-goers to coastal holidaymakers — making it essential to align your investment strategy with the location’s strengths.

With remote work, tourism growth and rising preference for unique stays, now is an ideal time to invest in UK Airbnbs and build a diversified short-term rental portfolio.

The UK’s Airbnb market is booming, offering a golden opportunity for investors looking to combine high returns with growing demand.

Travelers are moving away from traditional hotels and opting for unique, personalized stays that short-term rentals provide. Whether it’s a stylish city apartment, a coastal retreat or a countryside escape, the demand for Airbnb's has never been stronger.

However, not all markets are created equal. Investing in the right location can mean the difference between a steady income stream and an Airbnb rental property that struggles to secure bookings. By understanding market trends and choosing wisely, you can position yourself for success in this thriving short-term rental business.

This guide breaks down everything you need to know — why Airbnb investments are thriving, what to look for in a short-term rental property and the best Airbnb markets offering the best opportunities. If you’re ready to turn the Airbnb trend into a profitable venture, let’s explore how to make your investment property count.

The Top 10 UK Airbnb Markets to invest in are:

Manchester

Liverpool

Birmingham

Ashford (Kent)

Nottingham

Brighton and Hove

Edinburgh

Bath

Leeds

London

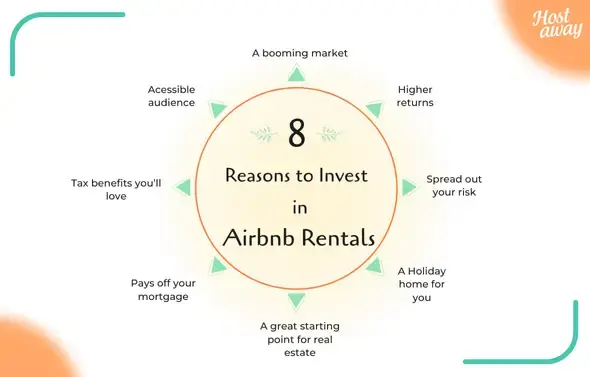

Why Invest in Airbnb Short-Term Vacation Rental Property?

1. A booming market

The short-term rental market is thriving, with demand consistently on the rise. People are ditching traditional hotels for more personalized stays, whether for vacations, work trips or a mix of both.

Plus, the rise of remote work means more people are looking for extended getaways, making Airbnb's a perfect fit.

2. Higher returns

Airbnb properties often bring in more cash flow compared to long-term rentals, especially in popular tourist spots or cities buzzing with business activity.

While returns can dip in slower seasons, partnering with a property manager who caters to business travelers and contractors can help smooth things out year-round.

3. Spread out your risk

With Airbnb, you're not relying on one tenant for a steady income. Instead, you have multiple guests booking throughout the year, which spreads out the risk.

If one guest cancels, it doesn’t tank your entire rental income.

4. A holiday home for you

Your Airbnb rental doesn’t just work for you — it can work for you. Block off dates to enjoy it yourself.

Whether it’s a cozy weekend escape or a base for a workcation, you can use the investment property when it’s not booked.

5. A great starting point for real estate

Short-term rentals are a fantastic way to ease into property investing. They’re often more hands-on, which gives you real-world experience without the long-term commitment of leasing to a single tenant

Even if you already own other real estate properties, because short-term rentals are a different market to other types of real estate, investing in helps diversify your assets.

6. Pays off your mortgage

The income from your Airbnb can help cover your mortgage payments, making it a smart way to build equity while enjoying extra cash flow.

For those worried about upfront costs, many lenders now offer competitive mortgage options for short-term rentals.

7. Tax benefits you’ll love

Owning a short-term rental can come with some nice tax perks. For example, if your property qualifies as a furnished holiday let (FHL), you can claim deductions for expenses like maintenance, mortgage interest and even marketing costs.

This setup can be more tax-efficient than standard long-term rentals.

8. Accessible audience

With OTAs like Airbnb accounting for a significant share in the travel market, it is easier than ever to market and attract short-term renters. Even generating direct bookings has become easier.

What to Look for When Picking a Market for Your Airbnb Property

Location

Location is everything. A property in a tourist hotspot or a bustling city center is likely to attract more guests than one in a remote or less appealing area.

Consider what the location offers — is it known for its attractions, nightlife or natural beauty? Can it draw different types of guests, such as business travelers, digital nomads or families?

Cities with strong corporate presence and proximity to transport hubs often have year-round demand, offering a broader guest base beyond just tourists.

Property type

The type of property you purchase plays a significant role in determining your target market. For instance, a high-end villa with a pool will appeal to luxury travelers, while a cozy studio with affordable rates might attract solo travelers or backpackers.

Amenities are equally important. Properties with fast Wi-Fi and workspaces can draw digital nomads, while fully equipped kitchens and extra bedrooms are a hit with families.

For those looking to provide all the amenities that ensure a comfortable stay, such as high-quality furnishings and smart home technology, your Airbnb rental will stand out and attract more guests.

Tailoring your property’s features to meet guest expectations ensures higher booking rates, positive reviews and memorable experiences.

State of the property

When purchasing an Airbnb property, you need to decide whether you want something move-in ready or a fixer-upper. A turnkey property allows you to start earning immediately, but it often comes at a higher price.

On the other hand, buying a property in need of renovation can save you money upfront, but don’t underestimate the time, costs and effort required to make it guest-ready.

If you’re considering a fixer-upper, be realistic about timelines — every day your vacation rental property isn’t listed is a day without generating passive income.

Year-round marketability

To maximize your investment, focus on attractive destinations with consistent year-round demand. While seasonal hotspots can be lucrative during peak times, they may leave you struggling during the off-season.

Look for areas with year-round appeal, such as cities that host festivals, sporting events or conferences.

Plus, properties in urban centers or near business districts often attract corporate clients or long-term relocators during slower tourist months, providing a steady stream of income.

ROI is key

Understanding the financial side of your investment is crucial. Start by researching the average property price and comparing it to the potential Airbnb income in your chosen area.

Factor in expenses like property management fees, cleaning services and maintenance costs to get a clear picture of your return on investment (ROI).

Ask yourself: How long will it take for your rental income to cover the initial purchase and operating costs? A market with a shorter break-even timeline is always more attractive.

Legislation

Before committing to a property, make sure you fully understand the local regulations governing short-term rentals.

Some cities have strict local rules, such as limits on the number of days you can rent out a property or requirements for special licenses. Additionally, zoning ordinances may dictate where short-term rentals are allowed, so it’s important to verify that your Airbnb rental is in a permitted area.

Plus, while Airbnb may handle some tax payments for you, it’s ultimately your responsibility to ensure compliance with local tax laws. Doing your homework upfront can save you headaches (and fines) later.

Future growth potential

Think about the long-term prospects of your chosen market. Is the area likely to grow in popularity or is it already saturated?

Keep an eye out for locations with planned developments, such as new tourist attractions, improved transport links or revitalized city centers.

These factors can boost property values and demand, making your investment even more lucrative over time. Undervalued areas with growth potential are especially worth considering for maximizing returns.

Top 10 Airbnb Markets to Invest in the UK

1. Manchester: The Northern powerhouse

Manchester blends industrial heritage with vibrant culture, attracting visitors year-round. From football fans at Old Trafford to music lovers at the AO Arena, its rich history, nightlife and attractions make it a favorite destination.

For real estate investors, Manchester offers strong rental demand and steady growth. With property prices averaging £296,578 and an average occupancy rate of 52%, it’s a top choice for profitable Airbnb investments.

2. Liverpool: Cultural and historical marvel

Liverpool is synonymous with music, history and football. As the birthplace of The Beatles and home to Anfield Stadium, the city draws millions of visitors annually.

Airbnb investors in Liverpool benefit from property prices averaging £213,587, a high daily rate of £138.60 and revenue of £23.4K. With a 47% occupancy rate, Liverpool delivers strong returns at an accessible entry point.

3. Birmingham: A rising star

Birmingham, the UK’s second-largest city, is a dynamic mix of business, culture and entertainment. With attractions like the historic Jewellery Quarter, Cadbury World and Michelin-starred restaurants, it has something for everyone.

The city’s vibrant events scene and picturesque canal network attract both leisure visitors and corporate travelers year-round.

Regular trade fairs and business events further boost high demand, making Birmingham’s thriving economy and rental market a top choice for Airbnb investors.

4. Ashford (Kent): The gateway to Europe

Ashford’s proximity to London and Eurostar connections make it an attractive location for Airbnb investors.

Its blend of scenic countryside and vineyards also appeals to both tourists and commuters. Affordable property prices and growing demand position Ashford as a rising hotspot in the real estate market.

5. Nottingham: The robin hood legacy

Nottingham, steeped in the lore of Robin Hood, combines historical charm with modern-day vibrancy. Attractions like Sherwood Forest and Nottingham Castle make it popular with families and history enthusiasts, while its two major universities draw students and visiting professionals year-round.

For real estate investors, Nottingham is a highly accessible market, with median property prices around £256,043.

Affordable entry costs and strong demand make Nottingham an appealing option for those looking to invest in a thriving market with plenty of character.

6. Brighton & Hove: The Coastal charmer

Brighton & Hove is one of the UK’s most beloved seaside destinations, famous for its artistic vibe, eclectic shops and iconic pier.

Its year-round tourism pull, amplified by events like Pride Festival and the allure of the Royal Pavilion, makes it a magnet for weekend getaways and summer holidays.

For Airbnb hosts, Brighton offers high returns, with average revenue potential of around £33.7K. Its proximity to London, just an hour by train, makes it a popular escape for city dwellers.

7. Edinburgh: The festival capital

Edinburgh, with its historic streets, stunning landmarks and world-renowned festivals, offers a blend of culture and charm. The Royal Mile and the Edinburgh Fringe Festival make it a must-visit destination.

Despite higher property prices, Airbnb hosts in Edinburgh enjoy high occupancy rates of 74%, with a nightly rate of £203 and a revenue potential of £54.6K, making it a top-tier investment location.

8. Bath: A UNESCO world heritage city

Bath is a historic treasure, known for its Roman Baths and Georgian architecture. It attracts affluent travelers seeking boutique stays and luxury experiences.

Property prices average £392,000, with an average daily rate of £165.4 and revenue potential of £36.7k. A 62% occupancy rate underscores Bath’s reliability as a premium Airbnb market.

9. Leeds: A business and cultural hub

.webp?u=https%3A%2F%2Fimages.ctfassets.net%2Fpqmtoyw9z10u%2F20uBVW1OFOpXVvS9xbWRjE%2Ffef98e5d98d663981769571d7cc44c7a%2FLeeds_A_business_and_cultural_hub__1_.webp&a=w%3D590%26h%3D393%26fm%3Dwebp%26q%3D75&cd=2024-12-23T23%3A03%3A50.314Z)

Leeds, a thriving city in West Yorkshire, has become a key destination for both business and leisure travelers.

Renowned for its financial and legal centers, as well as attractions like the Royal Armouries Museum and a dynamic shopping scene, Leeds is an exciting city to buy property for Airbnb investment.

The city offers affordability and strong potential for Airbnb hosts. With an average daily rate of £128.40 and an occupancy rate of 53%, Leeds continues to be a major player in the UK’s Airbnb market.

10. London: The crown jewel

.webp?u=https%3A%2F%2Fimages.ctfassets.net%2Fpqmtoyw9z10u%2F7mg6S6VRBlsVpi7eFx3acE%2F8dc3299bbe14d4538916760f66b55b13%2FLondon_The_crown_jewel__1_.webp&a=w%3D590%26h%3D368%26fm%3Dwebp%26q%3D75&cd=2024-12-23T23%3A04%3A39.714Z)

London remains a global powerhouse and one of the most visited cities in the world. From Buckingham Palace to the British Museum, its attractions are endless.

The city appeals to every type of traveler, from backpackers to luxury seekers, ensuring consistent demand. Though property prices are the highest, Airbnb hosts benefit from daily rates of £190, a strong 62% occupancy rate and revenue potential averaging £41.9K.

For those ready to invest in a competitive market, London offers exceptional returns.

Seize the Opportunity

Investing in Airbnb properties in the UK is an exciting opportunity to tap into a thriving market with strong potential for returns. From the vibrant culture of Manchester to the historic charm of Edinburgh and the coastal allure of Brighton, there’s a market to suit every type of vacation rental investor.

Success comes down to smart research, picking the right location and understanding your target guests. Whether you’re new to property investment or expanding an existing portfolio, short-term rentals offer flexibility, profitability and the chance to meet the growing demand for unique stays.

With the UK’s markets showing no signs of slowing, now is a great time to dive in. And if you’re looking to diversify even further, markets in the US, Mexico and Spain might be your next adventure.

Ready to find out how Hostaway can transform your business?