Data Shows Short-Term Rental Bookings Are Growing in Europe

.webp?u=https%3A%2F%2Fimages.ctfassets.net%2Fpqmtoyw9z10u%2F1b4S5yMMMWVJ4JuJx66hiG%2F1dfce20379babef7251b0445caeaa1e3%2FDALL_E_2024-08-26_11.52.10_-_A_picturesque_European_street_scene_representing_short-term_rental_accommodation_in_the_EU._Th.webp&a=w%3D960%26h%3D549%26fm%3Dwebp%26q%3D75&cd=2024-08-26T14%3A25%3A14.969Z)

Amid widespread concerns of market saturation and tightening regulations, the latest Eurostat report reveals a different story — short-term rental bookings in the EU are growing, year-on-year, as more travelers turn to online booking platforms for their accommodations.

Let’s take a look at the data and explore what it means for short-term rental hosts in the region.

Breaking Records in Continuing Expansion

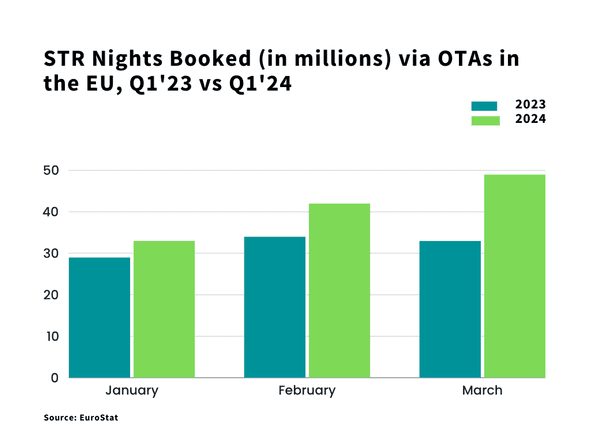

The short-term rental industry continues to grow in the EU. Travelers spent 123.7 million nights in short-term rental accommodations in the region in the first quarter of 2024, booked through Airbnb, Booking.com, TripAdvisor and Expedia Group — which includes Vrbo.

The numbers were higher, year-on-year, for each month, increasing 16.7%, 19% and 48% in January, February and March, respectively. Overall, nights booked via online platforms rose 28.3% in the first quarter of 2024, compared to the same period in 2023. The trend is a recurring one since 2021 and holds true across the12 months of the year.

Looking at annual data, guests spent 719 million nights in short-term rental accommodation in the EU in 2023, an increase of over 20%. In other words, nearly 2 million tourists slept in a bed booked via one of the online platforms, each night. The peak months of July and August accounted for over 1 in 3 guest nights.

While concerns of increasing competition, higher platform standards for hosts and tightening regulations are not unfounded, the Eurostat data puts fears of a contracting short-term rental market in the EU to rest.

Regional Differences

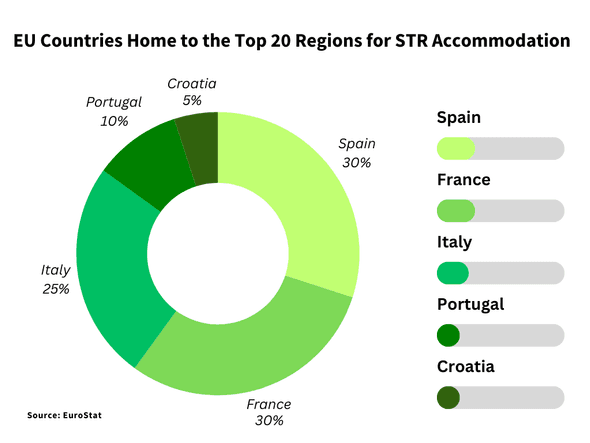

The most popular vacation rental markets continued to get outbooked by their less popular counterparts. According to Eurostat’s 2023 data, the 20 most popular regions accounted for nearly half of the total guest nights.

Spain, France, Italy, Portugal and Croatia were home to the top regions for short-term rental accommodation, accounting for six, six, five, two and one of the top 20 regions, respectively.

Paris continued to hold on to the title of the most popular city with nearly 20 million guest nights booked through online short-term rental booking platforms. And it’s already got a leg up on its rivals in 2024 with the boost from the Olympics.

Traveler Preferences: Rural vs. Urban

Travelers showed a preference for more than just vacation rentals on online booking platforms over traditional bookings. While urban centers like Paris and Barcelona continue to dominate the pole positions of the top destinations list, rural areas are attracting increasing numbers of travelers.

The regions of Andalusia in Spain (35.6 million nights), Jadranska Hrvatska in Croatia (32.6 million) and Provence-Alpes-Côte d’Azur (24.9 million) in France accounted for the highest number of short-term rental bookings via online travel platforms in 2023. The Southern region of Spain, Andalusia’s varied terrain is populated by large rural towns, small villages and provincial capitals and is known for its agricultural output. Also known as Adriatic Croatia, Jadranska Hrvatska is the coastal region of the country and is home to pristine forests, picturesque mountains and caves. And Provence-Alpes-Côte d’Azur, also known as Region Sud, is renowned for unspoiled landscapes and villages brimming with character.

The expansion in preference indicates that travelers are not only looking for convenient locations but also for properties that offer a local and personalized experience. Property managers can capitalize on this by curating experiences that cater to the interests of these travelers, such as offering local guides, traditional meals, unique amenities or thematic decor that reflects the destination's history, culture and environment.

Seasonal Trends and Pricing Strategies

The Eurostat data highlights significant seasonal fluctuations in bookings, with high peaks during summer. August, followed by July, continued to record the highest booking volumes, with September recording higher numbers than June.

Understanding these seasonal trends is crucial for property managers looking to optimize their pricing strategies. Implementing dynamic pricing, which adjusts rates based on demand, seasonality and local events, can help maximize occupancy and revenue. For instance, offering discounted rates during off-peak seasons or last-minute bookings can attract budget-conscious travelers while maintaining occupancy.

Expansion into Emerging Markets

While traditional markets like France, Spain and Italy continue to dominate, emerging markets are also showing promising growth. Eastern European countries such as Croatia are experiencing a surge in short-term rental accommodation bookings. Croatia, for example, welcomed a total of 20.6 million visitors who stayed 108 million overnights. This is a growth of 9% in arrivals and 3% in overnights compared to 2022.

For vacation rental managers looking to expand their base, emerging markets in Eastern Europe present enticing opportunities. With rising demand and less saturated markets, these regions offer a chance to establish a foothold with fewer regulatory hurdles.

Leveraging Data for Success

The rise of online short-stay accommodations in the European Union offers significant opportunities for property managers in the continent. By understanding market penetration, traveler preferences and seasonal trends, you can tailor your strategies to align with current demand. Leveraging data and insights from recognized reports like those produced by Eurostat can guide your decisions, ensuring your properties are well-positioned to thrive in this dynamic market.

Ready to find out how Hostaway can transform your business?