Simplify Your Finances in 2025: How to Streamline and Automate Invoice Management for Vacation Rentals

Managing invoices manually is a tedious and time-consuming process. This is true whether you manage 20 vacation rental properties or just one.

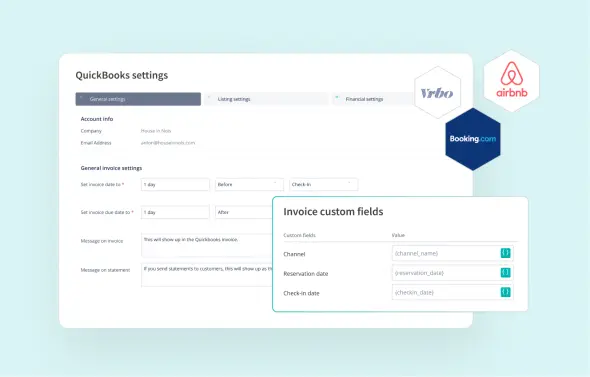

But in 2025, there’s no need to work harder when you can work smarter. Hostaway’s newly-launched integration with QuickBooks Online offers a seamless way to automate the repetitive tasks of invoice management, reducing errors, saving time and improving the overall efficiency of your business.

What Is QuickBooks Online?

QuickBooks Online is a popular accounting software designed to simplify financial management for businesses of all sizes, including short-term rental operations.

It is the cloud-based version of QuickBooks – a leading name in the accounting software industry – and is used by customers from around the world.

How Does QuickBooks Online Work for Property Managers?

QuickBooks Online offers essential accounting features that help users track income, manage expenses and streamline financial processes — all from an intuitive, user-friendly platform.

For vacation rental businesses, QuickBooks Online provides a versatile solution that integrates with Hostaway’s all-in-one vacation rental software, enabling short-term rental property managers and Airbnb owners to automate key processes like reservation data transfer, invoice creation and payment tracking and access the accounting module directly from the Hostaway dashboard.

This eliminates the need for manual bookkeeping and juggling between multiple applications. It also frees up time for vacation rental property managers to spend on strategic tasks without incurring the cost of paying for an accountant, making your short-term rental operations smarter and easier to scale.

What Are the Hidden Costs of Manual Invoice Management?

1. Double data entry equals double the trouble

Manually transferring reservation data into invoices isn’t just time-consuming — it’s error-prone. Even small mistakes can snowball into bad reviews, delayed payments and unnecessary stress. The more bookings you manage, the greater the likelihood of costly errors.

2. Time wasted on repetition

Every manual invoice takes at least several minutes to create. Multiply that by hundreds of bookings, and you’re looking at hours — if not days — of wasted time. This is time better spent figuring out your vacation rental upselling strategy, optimizing guest experiences or exploring new revenue streams.

3. Difficulty in tracking and customizing invoices

Without a streamlined system, keeping track of unpaid invoices, issuing reminders or tailoring invoices to specific needs can be overwhelming. For vacation rental hosts dealing with everything from cleaning expenses and pet fees to short-term rental tax calculations, the lack of a centralized system makes things unnecessarily complicated.

4. Lack of financial clarity

In a fast-paced industry like short-term rentals, financial clarity is essential for making informed decisions and staying ahead.

Without accurate and real-time insights into income, expenses and cash flow, identifying inefficiencies, reducing costs and planning for growth becomes a guessing game. This can lead to overspending, missed opportunities to optimize resources and uncertainty when scaling your vacation rental business.

How the Hostaway-QuickBooks Online Integration Benefits Property Managers

Hostaway’s integration with QuickBooks Online is designed to address the many pain points of manual invoicing. Here’s how it helps:

1. Cut down on manual data entry

With this integration, reservation data automatically transfers from Hostaway to QuickBooks. This eliminates the need for double data entry and drastically reduces the chance of errors.

Whether it’s a last-minute booking or a long-term stay, you can trust that the invoice will reflect the right information every time.

2. Save time with every invoice

By automating the creation of invoices with QuickBooks Online with Hostaway, you save three to five minutes per reservation data entry.

For a short-term rental property manager managing 100 bookings per month, that’s over five hours of reclaimed time that you can reinvest in your Airbnb business or personal life.

3. Track and tailor invoices effortlessly

With the QuickBooks Online integration, you can easily create and track invoices, customizing them to match the specific requirements of each use case. For example, add a custom line item for an urgent purchase you made on behalf of your guest or even invoice custom fields. The flexibility is built right in.

How the Hostaway-QuickBooks Online Integration Makes Tax Preparation Easier

Tax preparation is often a daunting task for short-term rental property owners and property managers. Even more so if you are managing properties across state lines or even countries with multiple tax codes coming into play.

Hostaway’s QuickBooks Online integration simplifies the tax preparation process by automatically categorizing expenses, tracking and calculating sales and occupancy taxes across different jurisdictions and ensuring potential deductions are accurately tracked throughout the financial year.

Plus, you can easily generate financial statements like profit and loss statements and cash flow summaries that provide a clear financial snapshot, alleviating that tax season stress.

Work Smarter in 2025

Manual invoice management belongs to the past.

With Hostaway’s QuickBooks Online integration, you gain the tools to streamline your financial operations, reduce errors and save time in the long run. In 2025, working smarter means embracing automation and letting technology handle the repetitive tasks while you focus on what truly matters — your guests and your vacation rental business’ growth.

FAQs

1. What is QuickBooks Online, and how does it help vacation rental property managers?

QuickBooks Online is a cloud-based accounting software that simplifies financial management. For vacation rental property managers, it streamlines tasks such as invoice creation, expense tracking and tax preparation. Its integration with Hostaway allows for automated reservation data transfer, reducing manual work and errors.

2. How does the Hostaway-QuickBooks Online integration save time?

The integration automates repetitive tasks like transferring reservation data and creating invoices. By eliminating manual data entry, property managers can save 3–5 minutes per invoice, reclaiming valuable hours each month to focus on growing their business.

3. Can I customize invoices with the Hostaway-QuickBooks Online integration?

Yes! The integration allows you to create tailored invoices that match your specific needs. You can add custom line items and fields, and include personalized price breakdowns to align with unique use cases, such as cleaning fees or security deposits.

4. Is the Hostaway-QuickBooks Online integration suitable for hosts managing a single property?

Absolutely. Whether you manage one property or dozens, the integration can save time, reduce errors and streamline financial processes. The time and effort saved are valuable for hosts at any scale.

5. How do I access QuickBooks Online through Hostaway?

Once integrated, QuickBooks Online can be accessed directly from the Hostaway dashboard. This seamless connection eliminates the need to switch between multiple applications, making financial management more efficient.

6. Will the integration help me track unpaid invoices?

Yes, the integration makes it easy to monitor the status of invoices — paid, unpaid or overdue. This ensures you stay on top of payment tracking and follow-ups, improving cash flow and reducing delays.

Ready to find out how Hostaway can transform your business?