Airbnb and Short-Term Rental Laws in Toulouse

.webp?u=https%3A%2F%2Fimages.ctfassets.net%2Fpqmtoyw9z10u%2F20AwvaIDoPZGOVXuHR6tgn%2F2c2e3fb5aaf7b1c83c54dd7ade49f341%2FToulouse__France__Opt_1_.webp&a=w%3D960%26h%3D640%26fm%3Dwebp%26q%3D75&cd=2024-11-19T17%3A13%3A28.051Z)

France remains a top travel destination, attracting millions of visitors each year and it’s no surprise why. According to the U.N., France is the most visited country globally, with the USA taking second place. If you're considering investing in a charming apartment in the Pink City, there's something you need to know: there is a maze of Airbnb and short-term rental laws in Toulouse that you'll have to follow.

For hosts and property managers, understanding these regulations is more critical than ever. From mandatory property registration to limits on the number of rental days, failing to comply could result in heavy fines or even suspension of your listing.

In this article, we’ll break down the latest short-term rental laws in Toulouse, equipping you with the essential information to stay compliant while maximizing your rental income. Whether you manage one property or multiple, knowing the rules is key to running a successful Airbnb business in Toulouse.

Why Tourists Love Toulouse?

Toulouse, fondly called "La Ville Rose" (The Pink City), is a city that effortlessly enchants its visitors with a vibrant mix of history, culture and lively modern energy. The city's nickname comes from its unique pink terracotta buildings, which give the streets a warm, glowing charm. Toulouse is also home to remarkable landmarks like the Basilica of Saint-Sernin, a grand Romanesque church and the Capitole de Toulouse, a striking building that showcases the city’s rich history.

Toulouse is more than just its charming streets and historic architecture. It’s also a major player in the aerospace industry, serving as the headquarters of Airbus and home to the Cité de l’Espace, a space-themed park and museum that captivates visitors with interactive exhibits about space exploration.

In addition to its tech-savvy appeal, the city thrives culturally, with renowned institutions like the Musée des Augustins, housing exceptional art collections and a calendar packed with lively festivals that celebrate everything from music to art, keeping the city's creative energy alive all year.

Located near both the Pyrenees and the Mediterranean, Toulouse is also perfectly placed for outdoor enthusiasts. Whether you're strolling along the Garonne River or exploring nearby vineyards and scenic countryside, Toulouse has a way of offering the best of both urban and natural worlds, making it a favorite destination for travelers seeking a well-rounded experience.

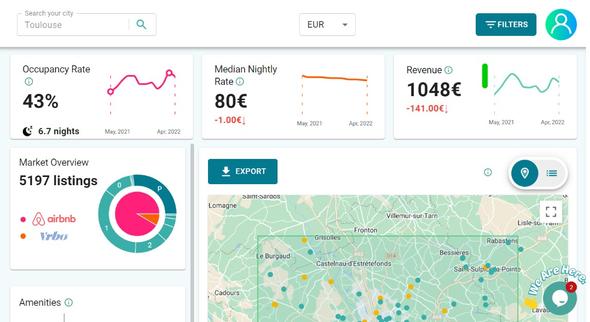

Source: Airbtics

Is Airbnb Legal in Toulouse?

Yes, Airbnb is legal in Toulouse!

Currently, there are around 4,756 active Airbnb listings in the city, with 54% being entire homes that can earn up to €1,382 per month. Of these listings, 19% are managed by professionals, while the majority—81%—are managed independently by individual hosts. Apart from full houses, 27% of the listings are private rooms and 18% are apartments or condos. The average occupancy rate in Toulouse sits at 43%, with a typical daily rate of around €80. If you’re hosting a two-bedroom apartment, you could potentially earn up to €19,020 per year, according to data from Airbtics.

These figures highlight the thriving short-term rental market in Toulouse, offering promising opportunities for hosts while still complying with local regulations.

Short-Term Rental Policies in Toulouse

If you're planning to rent out a property in Toulouse on a short-term basis, there are a few important rules to follow.

First things first, you must register your furnished tourist accommodation with the local town hall, ensuring that your rental is legally recognized and have this registration number displayed clearly on all of your listings.

If the property is your main residence, whether you own or rent it, you're only allowed to rent it out for up to 120 days per year. This limit helps protect the local housing market while still allowing hosts to generate income from short-term rentals.

Additionally, you must collect a tourist tax from your guests, which is charged per person, per night. The amount varies based on the type of accommodation and its classification, so be sure to check the specific rate for your property. By following these simple steps, you can ensure your rental business in Toulouse remains compliant with local laws.

Tourist tax: Accommodation type vs. tax rates

Palaces - 4.60 €

5-star tourist hotels, 5-star tourist residences, 5-star furnished tourist accommodation - 3.30 €

4-star tourist hotels, 4-star tourist residences, 4-star furnished tourist accommodation - 2.50 €

3-star tourist hotels, 3-star tourist residences, 3-star furnished tourist accommodation - 1.60 €

2-star tourist hotels, 2-star tourist residences, 2-star furnished tourist accommodation - 1.00 €

1-star tourist hotels, 1-star tourist residences, 1-star furnished tourist accommodation - 0.80 €

Campsites and caravan sites classified as 3, 4 and 5 stars and any other outdoor accommodation site of equivalent characteristics, pitches in camper van areas and tourist car parks per 24-hour period - 0.60 €

Campsites and caravan sites classified as 1 and 2 stars and any other outdoor accommodation site of equivalent characteristics, marinas - 0.20 €

Accommodation awaiting classification or without classification, with the exception of other categories of accommodation mentioned below (rate proportional to the cost of the night) - 5%

Department tax

The local departmental council has an additional tax of 10% on top of the existing tourist tax collected by municipalities or public inter-municipal bodies in the region. This tax applies to areas that already charge a tourist tax and is used to support tourism development in the department. Similarly, the Lyon metropolitan area has the option to apply this same 10% additional tax to help fund its tourism initiatives.

This extra tax is managed in the same way as the original tourist tax and the revenue collected is directed toward projects that promote local tourism. Essentially, it's a way for local governments to generate more funds for boosting the tourism sector, ensuring the region remains an attractive destination for visitors.

Regional tax to be paid over the Société du Grand Paris

An additional 15% tax is applied to the existing tourist tax or flat-rate tourist tax collected by municipalities and certain inter-municipal bodies. This extra tax is calculated and collected in the same way as the regular tourist tax. Once collected, the funds are transferred at the end of the collection period to the “Société des Grands Projets,” a public organization responsible for funding major infrastructure and development projects in the region.

Additional regional tax

In the departments of Hérault, Aude and Pyrénées-Orientales, an additional 34% tax is applied to the existing tourist tax or flat-rate tourist tax collected by municipalities and certain inter-municipal organizations. This extra tax is collected in the same way as the regular tourist tax. Once gathered, the funds are directed to the local public organization, Société de la Ligne Nouvelle Montpellier-Perpignan, which was created to finance the development of the new Montpellier-Perpignan railway line.

General Legislations in France:

Under France's updated rental laws, there are certain situations where you no longer need to register your accommodation. If you're renting out a single room in your primary residence or offering a bed and breakfast (chambre d’hôtes), hotel or similar type of accommodation, registration is no longer required.

Additionally, if you are renting under the “bail mobilité” scheme, which is designed for tenants engaged in professional training, higher education, internships or temporary work assignments, you’re exempt from registration, as long as the lease is for at least one month.

Similarly, long-term rentals lasting a minimum of one year do not require registration. However, if you are renting out your primary or secondary residence in Paris for less than or more than 120 days per year, it’s mandatory to declare the property with the Town Hall (Mairie de Paris) to ensure compliance with local regulations. These rules help regulate short-term rentals while maintaining flexibility for different types of accommodations.

General Short-Term Rental Policies in France

There are specific regulations that apply to short-term rentals in France. First, any income earned from renting out furnished properties must be declared in your annual tax return under the Industrial and Commercial Profit (BIC) category.

If you're hosting guests under a mobility lease, they are automatically exempt from paying the tourist tax, which simplifies the process for this type of rental. For primary residences, you are allowed to rent the entire property for a maximum of 120 days per year. However, if you're renting out a secondary residence, you can do so year-round, as long as you’ve officially declared your rental activity to the city. These rules are in place to ensure proper tax reporting and to regulate the short-term rental market in France.

Thriving as a Short-Term Rental Host in Toulouse

Toulouse, with its unique charm and booming tourism industry, presents an incredible opportunity for Airbnb hosts and property managers. While navigating the local regulations might seem daunting at first, these rules are designed to help maintain the city's balance between its vibrant tourist appeal and residential life. By staying compliant with short-term rental laws, such as the 120-day limit for primary residences and proper tax reporting, you can confidently host guests and enjoy the rewards.

Ready to find out how Hostaway can transform your business?